Esurance Auto Insurance Quote by ZIP Code

Use this page to run a clean, ZIP-based Esurance auto insurance quote and compare coverage setups without guessing. The goal is simple: keep one baseline (same ZIP, drivers, vehicle, and limits), then adjust only one lever at a time—deductible, coverage level, or add-ons—so you can see what truly changes the price.

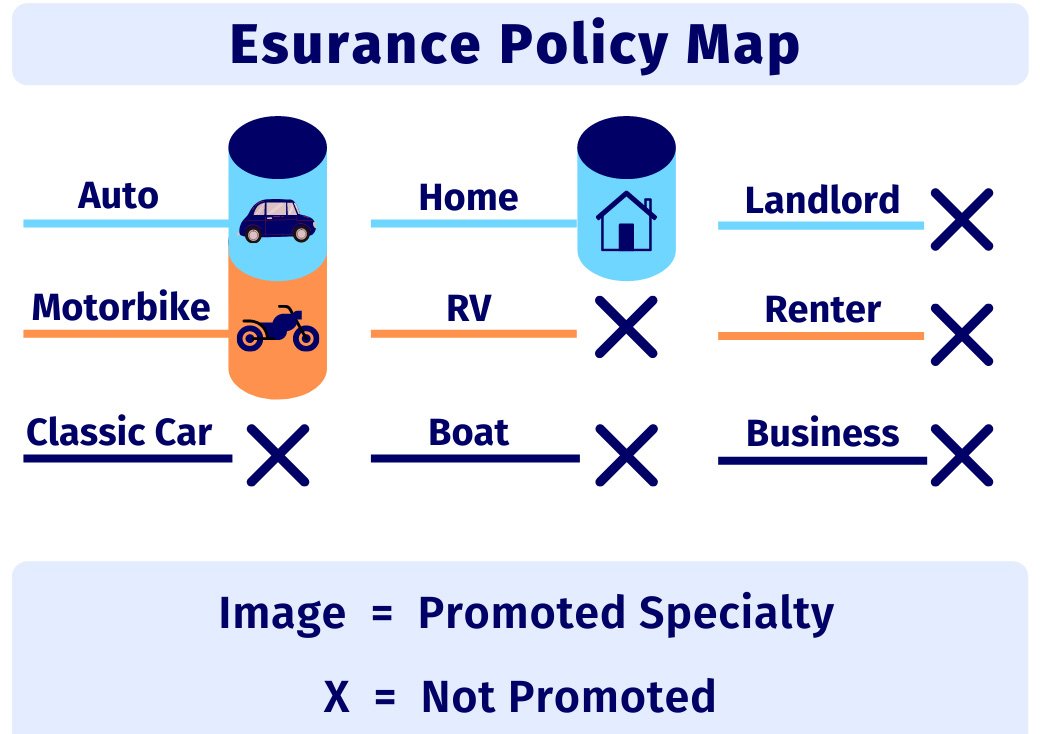

If you want to compare auto and home on one screen, use the main hub: Esurance insurance quotes.

Check Auto Insurance Prices in Your ZIP

Enter your ZIP code below to see real-time auto offers tailored to your location and driving profile. There’s no obligation and no hidden fees—just a fast way to benchmark pricing and then refine your coverage choices.

Auto Insurance Quote

Compare auto rates in seconds and review coverage options side by side.

What You’ll See After You Enter Your ZIP

After you submit your ZIP, you’ll typically see multiple pricing paths based on the same driver and vehicle profile. The most common differences come from: coverage limits, collision/comprehensive deductibles, and optional add-ons such as roadside assistance or rental reimbursement.

To compare accurately, start with one “standard” setup (your current limits and deductibles), save the baseline price, and then test one change at a time. That approach prevents the classic mistake: choosing a lower premium that is only lower because protection was reduced.

Liability vs Full Coverage

Liability-only is the lowest-cost structure, but it won’t pay to repair your own vehicle after an at-fault accident. Full coverage usually means adding collision and comprehensive, which is more expensive but can be the right choice for newer vehicles or loans/leases. If you’re unsure which structure fits, use this overview: Esurance full coverage auto insurance.

A simple rule of thumb: if the vehicle’s value is modest and you can comfortably handle a loss, liability-only can be reasonable. If a loss would create a financial hit, full coverage may be worth the extra cost.

Deductibles and Add-Ons That Move the Price

Deductibles often have one of the cleanest impacts on premium: higher deductibles usually lower the monthly cost, while lower deductibles increase it. The best choice is the deductible you can actually pay on a bad day—not the lowest number on the screen.

Add-ons can also change value significantly. Roadside assistance can be useful for older cars; rental reimbursement can matter if you rely on your vehicle daily. Add them only if they solve a real problem for your routine.

Discounts You Can Actually “Stack”

Discounts vary by state, but the strongest savings commonly come from safe driving, multi-car setups, bundling, and certain payment choices. If you want the full eligibility checklist, use this page: Esurance auto insurance discounts.

One practical way to test discount impact: run one quote with your current setup, then run a second quote after toggling only the discount-related variable (for example, paperless, pay-in-full, or usage-based tracking if available).

Why Drivers Use Esurance for Auto Quotes

Esurance is built for fast comparison and simple policy management. You can review pricing, adjust coverage, and handle documents in one online flow. For many drivers, that speed matters most near renewal, when it’s easy to accept a higher price just to “get it done.”

If you’re shopping providers, it can help to compare how features, pricing tools, and claims workflows differ. Here’s a side-by-side overview: compare Esurance vs competitors.

Bundling Without Making Links Look Spammy

Bundling can reduce total household cost, but it’s smarter to compare the combined total rather than chasing a tiny auto-only discount. If you’re also pricing home coverage, run a separate home quote here: home insurance quotes from Esurance.

Then compare: (1) auto-only total, (2) home-only total, and (3) bundled total. That’s the clearest way to see whether bundling helps in your ZIP.

Affordable Options Without Cutting Corners

If your goal is to reduce premium while keeping protection realistic, start with deductible testing and discount stacking before lowering liability limits. For a dedicated cost-reduction guide (without turning this page into “cheap quotes” overlap), use: Esurance cheap auto insurance guide.

External Reference for Broader Market Context

If you want a broader view of Esurance pricing across a larger comparison ecosystem, you can also review: esurance car insurance quotes. Use it as a secondary reference, then return here to run your ZIP-based baseline and test changes cleanly.